Monetary Shocks and Sticky Wages in the U.S. Great Contraction: A Multi-Sector Approach

Abstract

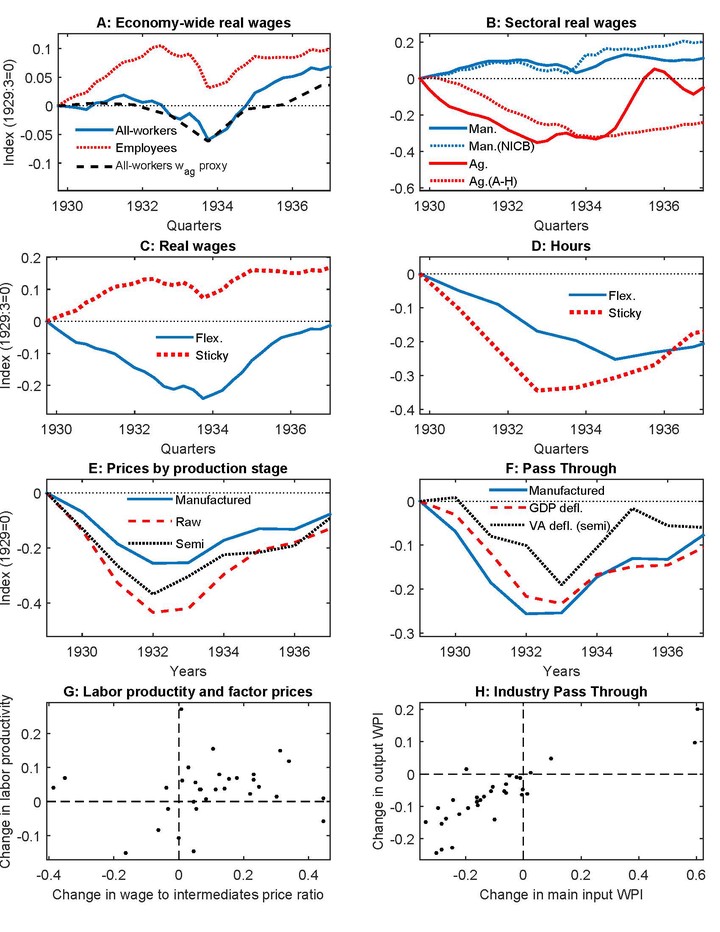

We quantify the role of contractionary monetary shocks and nominal wage rigidities in the U.S. Great Contraction. In contrast to conventional wisdom, we find little increase in the economy-wide real wage over 1929-33, although real wages rose significantly in some industries. In the context of a two-sector model with intermediates and nominal wage rigidities in one sector, contractionary monetary shocks account for only a third of the fall in GDP. Intermediate linkages play an important role, as the output decline without intermediates is almost a third larger at the trough. The role of nominal wage rigidities beyond their interaction with monetary shocks is limited.

Type

Publication

Journal of Monetary Economics