Cash-flow Tranching and the Macroeconomy

Abstract

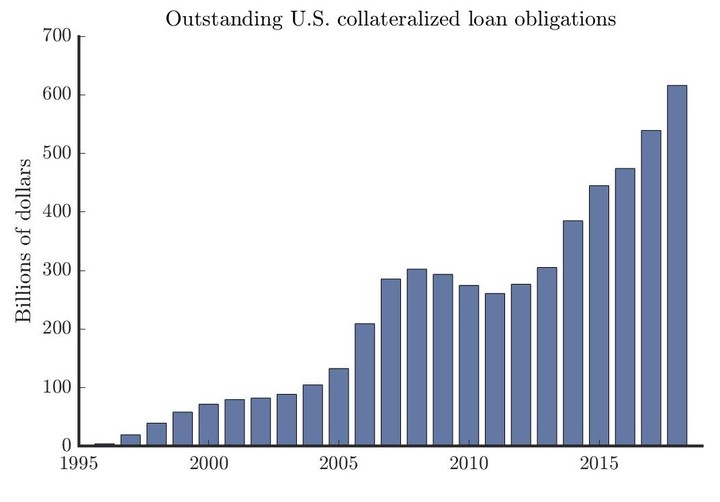

The volume of cash-flow transformation activities has grown markedly over the past few decades as a result of technological improvements, regulatory arbitrage, and increased appetite for safe assets, among other factors. We develop a dynamic model where the effects of changes in the costs and benefits of security creation activities can be characterized. Reduced tranching costs and increases in foreign appetite for safe assets can both create large increases in the volume of costly security creation with positive effects on GDP and wages, but they have otherwise very different macroeconomic implications. Reductions in tranching costs counterfactually cause yields to rise, implying that household welfare rises significantly more than output. In contrast, increased foreign demand for safe assets brings yields down and also causes the rents associated with cash-fow transformation to increase. These two features as well as several other subsidiary implications of increased foreign demand in our model, are consistent with recent U.S. data.